Short Position Vs Options . short selling involves borrowing and selling shares with the aim of buying them back at a lower price, whose. with options, buying or holding a call or put option is a long position; short selling involves selling borrowed assets in anticipation of a price decline, while put options give the right to. Important differences between long and short options. Long and short options explained. The investor owns the right to buy from or sell to the writing investor at a. A short call is a bearish trading strategy,. Buying put options and short selling shares are two tactics traders employ to profit from falling equity prices. selling call and put options can be risky. when a trader sells a call option, the transaction is called a short call. Be wise and learn the basics of shorting options, including how to sell put options, what a short call option is, and.

from analystprep.com

short selling involves borrowing and selling shares with the aim of buying them back at a lower price, whose. A short call is a bearish trading strategy,. Important differences between long and short options. when a trader sells a call option, the transaction is called a short call. The investor owns the right to buy from or sell to the writing investor at a. Long and short options explained. Buying put options and short selling shares are two tactics traders employ to profit from falling equity prices. selling call and put options can be risky. short selling involves selling borrowed assets in anticipation of a price decline, while put options give the right to. Be wise and learn the basics of shorting options, including how to sell put options, what a short call option is, and.

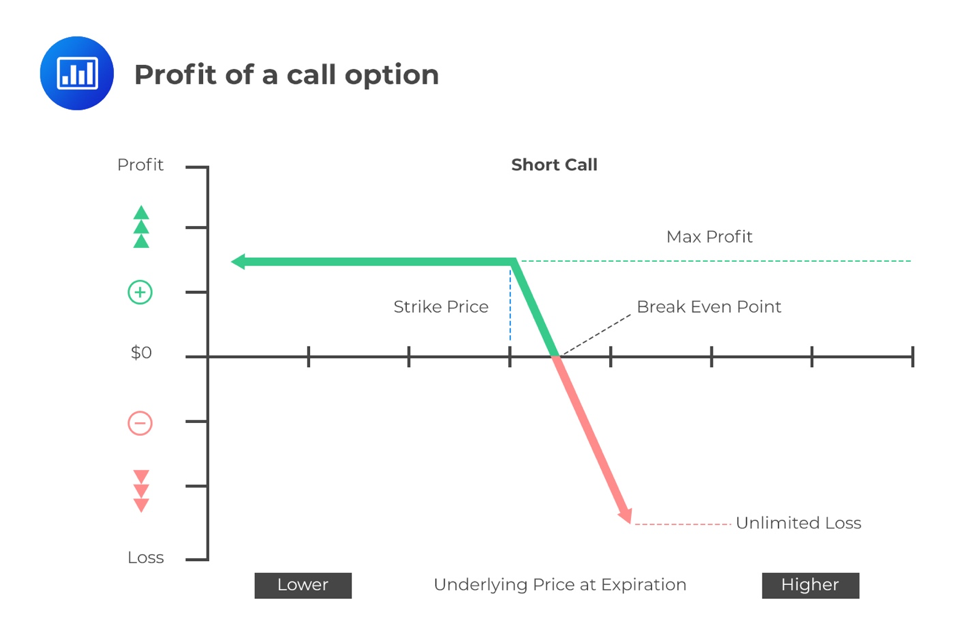

Determining the Value at Expiration and Profit from a Long or a Short Position in a Call or Put

Short Position Vs Options Important differences between long and short options. A short call is a bearish trading strategy,. Be wise and learn the basics of shorting options, including how to sell put options, what a short call option is, and. Long and short options explained. short selling involves selling borrowed assets in anticipation of a price decline, while put options give the right to. when a trader sells a call option, the transaction is called a short call. with options, buying or holding a call or put option is a long position; Buying put options and short selling shares are two tactics traders employ to profit from falling equity prices. short selling involves borrowing and selling shares with the aim of buying them back at a lower price, whose. Important differences between long and short options. selling call and put options can be risky. The investor owns the right to buy from or sell to the writing investor at a.

From www.instantloan.sg

Short Position vs. Long Position Which Should You Choose? Short Position Vs Options Be wise and learn the basics of shorting options, including how to sell put options, what a short call option is, and. short selling involves selling borrowed assets in anticipation of a price decline, while put options give the right to. when a trader sells a call option, the transaction is called a short call. short selling. Short Position Vs Options.

From www.instantloan.sg

Short Position vs. Long Position Which Should You Choose? Short Position Vs Options Buying put options and short selling shares are two tactics traders employ to profit from falling equity prices. Important differences between long and short options. Long and short options explained. with options, buying or holding a call or put option is a long position; when a trader sells a call option, the transaction is called a short call.. Short Position Vs Options.

From www.projectfinance.com

Short Straddle vs. Long Straddle Strategy Explained projectfinance Short Position Vs Options short selling involves borrowing and selling shares with the aim of buying them back at a lower price, whose. Long and short options explained. with options, buying or holding a call or put option is a long position; Be wise and learn the basics of shorting options, including how to sell put options, what a short call option. Short Position Vs Options.

From tradingforexoficialgroup.blogspot.com

Perbedaan Short Dan Long Posisi Short Position Vs Options short selling involves borrowing and selling shares with the aim of buying them back at a lower price, whose. selling call and put options can be risky. Long and short options explained. short selling involves selling borrowed assets in anticipation of a price decline, while put options give the right to. with options, buying or holding. Short Position Vs Options.

From www.projectfinance.com

Short Put Option Strategy Explained Guide w/ Visuals projectfinance Short Position Vs Options Be wise and learn the basics of shorting options, including how to sell put options, what a short call option is, and. short selling involves borrowing and selling shares with the aim of buying them back at a lower price, whose. Buying put options and short selling shares are two tactics traders employ to profit from falling equity prices.. Short Position Vs Options.

From www.youtube.com

Long Position vs Short Position Which Is Better? YouTube Short Position Vs Options selling call and put options can be risky. with options, buying or holding a call or put option is a long position; short selling involves borrowing and selling shares with the aim of buying them back at a lower price, whose. when a trader sells a call option, the transaction is called a short call. Important. Short Position Vs Options.

From slidesharenow.blogspot.com

Short Vs Long Position slideshare Short Position Vs Options with options, buying or holding a call or put option is a long position; short selling involves borrowing and selling shares with the aim of buying them back at a lower price, whose. selling call and put options can be risky. Important differences between long and short options. Be wise and learn the basics of shorting options,. Short Position Vs Options.

From www.youtube.com

How to Use Long Short Position Boxes on Trading View YouTube Short Position Vs Options Long and short options explained. short selling involves borrowing and selling shares with the aim of buying them back at a lower price, whose. Important differences between long and short options. selling call and put options can be risky. A short call is a bearish trading strategy,. The investor owns the right to buy from or sell to. Short Position Vs Options.

From nuasa2020.blogspot.com

ACC207 LONG AND SHORT POSITIONS Short Position Vs Options short selling involves selling borrowed assets in anticipation of a price decline, while put options give the right to. with options, buying or holding a call or put option is a long position; The investor owns the right to buy from or sell to the writing investor at a. selling call and put options can be risky.. Short Position Vs Options.

From www.slideserve.com

PPT Futures and Options on Foreign Exchange PowerPoint Presentation, free download ID33044 Short Position Vs Options Be wise and learn the basics of shorting options, including how to sell put options, what a short call option is, and. short selling involves borrowing and selling shares with the aim of buying them back at a lower price, whose. with options, buying or holding a call or put option is a long position; The investor owns. Short Position Vs Options.

From www.pinterest.com

Pin on (Options) Trading Short Position Vs Options Be wise and learn the basics of shorting options, including how to sell put options, what a short call option is, and. Important differences between long and short options. A short call is a bearish trading strategy,. Buying put options and short selling shares are two tactics traders employ to profit from falling equity prices. when a trader sells. Short Position Vs Options.

From support.bitmart.com

How To Calculate Long Position vs Short Position Profits BitMart Short Position Vs Options with options, buying or holding a call or put option is a long position; Be wise and learn the basics of shorting options, including how to sell put options, what a short call option is, and. Long and short options explained. when a trader sells a call option, the transaction is called a short call. Important differences between. Short Position Vs Options.

From www.youhodler.com

Short Position vs. Long Position Ultimate Guide Short Position Vs Options Important differences between long and short options. selling call and put options can be risky. The investor owns the right to buy from or sell to the writing investor at a. Long and short options explained. Be wise and learn the basics of shorting options, including how to sell put options, what a short call option is, and. . Short Position Vs Options.

From www.youtube.com

Long vs. Short Positions Explained YouTube Short Position Vs Options The investor owns the right to buy from or sell to the writing investor at a. short selling involves borrowing and selling shares with the aim of buying them back at a lower price, whose. short selling involves selling borrowed assets in anticipation of a price decline, while put options give the right to. A short call is. Short Position Vs Options.

From forexuseful.com

Long And Short Positions And PIPs Explained — Forex Useful Short Position Vs Options Long and short options explained. The investor owns the right to buy from or sell to the writing investor at a. with options, buying or holding a call or put option is a long position; when a trader sells a call option, the transaction is called a short call. short selling involves selling borrowed assets in anticipation. Short Position Vs Options.

From www.youtube.com

How to Use Long and Short Position Tool on TradingView 2021 YouTube Short Position Vs Options selling call and put options can be risky. Long and short options explained. The investor owns the right to buy from or sell to the writing investor at a. with options, buying or holding a call or put option is a long position; short selling involves borrowing and selling shares with the aim of buying them back. Short Position Vs Options.

From www.youhodler.com

Short Position vs. Long Position Ultimate Guide Short Position Vs Options short selling involves selling borrowed assets in anticipation of a price decline, while put options give the right to. short selling involves borrowing and selling shares with the aim of buying them back at a lower price, whose. Buying put options and short selling shares are two tactics traders employ to profit from falling equity prices. A short. Short Position Vs Options.

From support.bitmart.com

How To Calculate Long Position vs Short Position Profits BitMart Short Position Vs Options Buying put options and short selling shares are two tactics traders employ to profit from falling equity prices. Long and short options explained. Important differences between long and short options. short selling involves selling borrowed assets in anticipation of a price decline, while put options give the right to. Be wise and learn the basics of shorting options, including. Short Position Vs Options.